Development of Banking in Kenya

The financial journey in Kenya dates back to the pre-colonial periods. At first, the pioneering banks concentrated on financing international trade along the Europe-South Africa–India axis. They, however, soon diversified operations to tap the opportunities for profitable banking created by a growing farming settler community and pioneer traders in the local economy to whom they provided deposit and credit facilities. It was only a matter of time for banking to spread into the interior.

It all started with Indian money lenders operating quasi bank services probably as early as the 18th century but the first recognisable bank was Jetha Lila Bankers from India, which was established in Zanzibar in 1880. In 1889 the National Bank of India appointed the trade house of Smith Mackenzie to be their agent in Zanzibar. Smith Mackenzie had a Mombasa branch in 1887 which was taken over by the Imperial British East Africa (IBEA) in 1888. The National Bank of India established its own office in Zanzibar in 1892. In July 1896 the National Bank of India established a branch in Mombasa renting premises from Sheriff Jaffer. The spread continued to 1904 when they opened a branch in Nairobi.

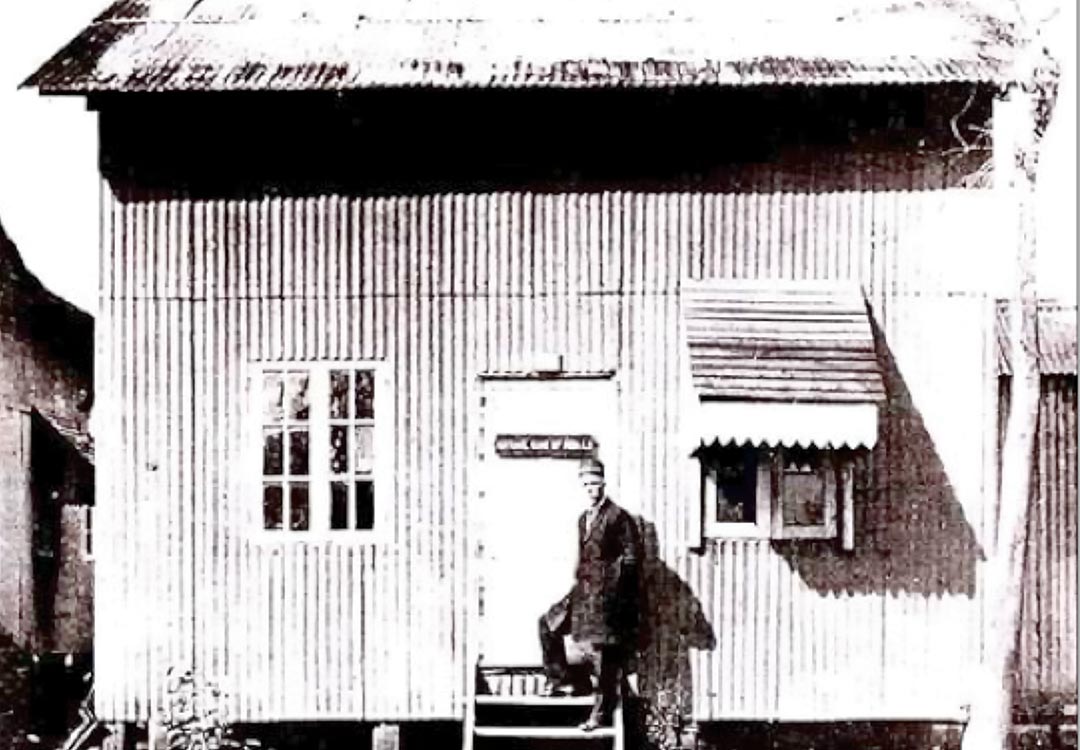

National Bank of India, Nairobi on August, 1904.

In April, 1909, the East Africa Post Office Savings Bank Ordinance was passed and in April of the following year, the Ordinance for the Regulation of Banks Established or to be Established in the East Africa Protectorate was passed. The former Ordinance established the first bank in the formal sense while the latter enabled the National Bank of India to become the first commercial bank. By 1911 there were only three banks:-

- The National Bank of India with branches in Mombasa, Nairobi, Nakuru and Kisumu.

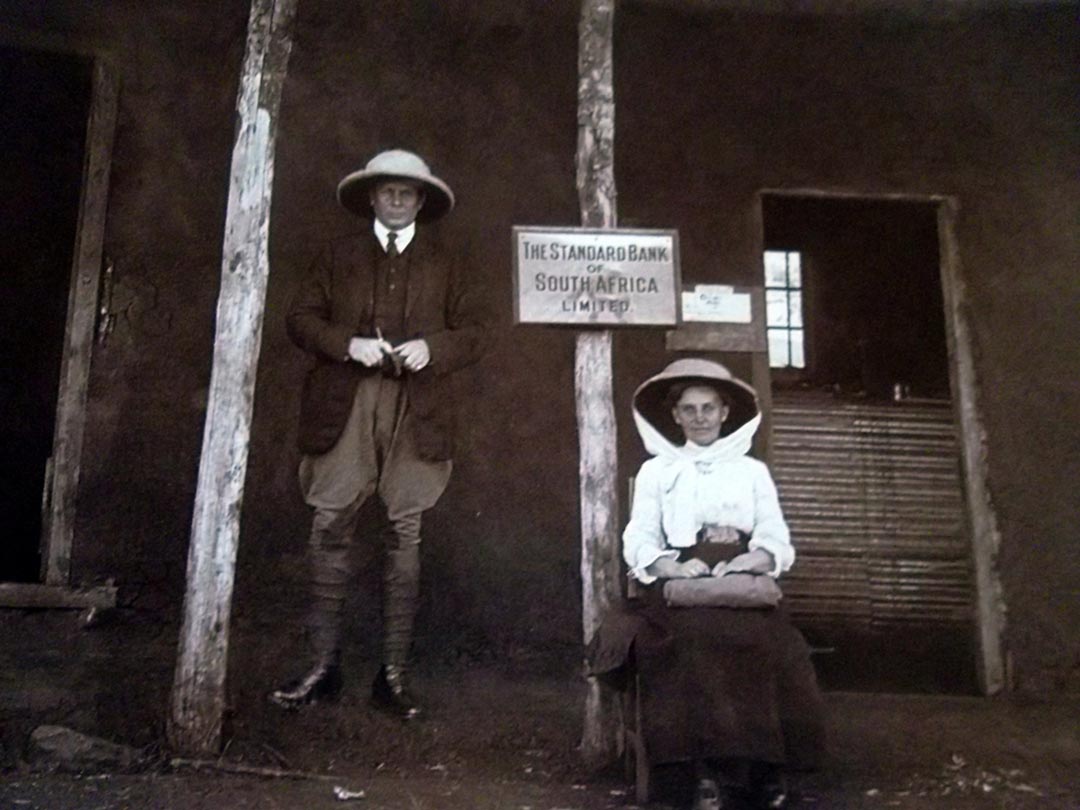

- The Standard Bank of South Africa having come in December, 1910 – operating in four locations: Mombasa (3 branches), Nairobi (2 branches), Nakuru and Kisumu.

- Kathiawad and Ahmedabad Banking Corporation had a shortlived presence in Mombasa from 1910 to 1915.

The Standard Bank of South Africa Limited, Eldoret, 1912

The expansion of the banking networks grew from one branch in the town of Mombasa in 1896 to eight branches in five towns before the First World War having added Nairobi, Nakuru, Kisumu and Eldoret. The National Bank of South Africa, which was to become Barclays Bank DCO in 1926, arrived in Mombasa in 1916. During the Great Depression from 1929 to 1939, there was a gold rush to Kakamega and in 1934 there were two bank branches opened in the town to service the prospectors. These branches did not survive and were closed during the Second World War. By 1948, banks were to be found in 10 towns having expanded to Nyeri, Nanyuki, Kitale, Kericho and Thompson’s Falls (Nyahururu) with 18 branches as Mombasa, Nairobi, Nakuru and Kisumu all got representation from the three banks.

As time progressed, the changing landscape of banking began to note the entrance of fully indigenous banks. Kenya’s first fully locally owned commercial bank was the Co-operative Bank of Kenya, which was initially a co-operative society. It served the needs of growing farming communities and started operations in 1968. In the same year, the National Bank of Kenya became the first fully-owned government bank. In 1971, the Kenya Commercial Bank was formed following the merger of the National and Grindlays Bank, with the government owning a 60-per cent majority stake. It took poll position as the largest of the country’s commercial banks in terms of deposits and number of branches.

After independence, the banking sector in Kenya has continued to grow, reflecting the country’s growth towards economic prosperity.