Governance

The Central Bank of Kenya is managed by staff with diversified skills including economists, statisticians, accountants, lawyers, communications specialist, information technology experts and human resources professionals amongst others. This pool of talented staff ensures effective and efficient implementation of the Bank’s mandate.

Board of Directors

Role and Legal Status

Under the Central Bank of Kenya Act (Cap. 491), the responsibility for determining the policy of the Bank, other than the formulation of monetary policy, is given to the Board of Directors. The Board of Directors of the Central Bank of Kenya is responsible for:

(a) Determining the policy of the Bank, other than the formulation of monetary policy.

(b) Determining the objectives of the Bank, including oversight for its financial management and strategy.

(c) Keeping under constant review the performance of the Bank in carrying out its functions.

(d) Keeping under constant review the performance of the Governor in discharging the responsibility of that office.

(e) Keeping under constant review the performance of the Governor in ensuring that the Bank achieves its Objectives.

(f) Determining whether the policy statements made are consistent with the Bank’s primary function and policy objectives of the Bank.

(g) Keeping under constant review the use of Bank’s resources.

Membership

The Board comprises 11 members consisting of the Chairperson, the Governor; the Permanent Secretary to the National Treasury or his representative who shall be a non-voting member, and eight other non-executive directors.

The chairperson and directors are appointed by the President with the approval of Parliament and hold office for a period of four years but shall be eligible for re-appointment for one further term of four years. Persons eligible to be appointed to the Board must be citizens of Kenya who are knowledgeable or experienced in monetary, financial, banking and economic matters or other disciplines relevant to the functions of the Bank.

Meetings

The Chairperson convenes the meetings of the Board not less than once in every two months, or whenever the business of the Bank so requires, or whenever he is so requested in writing by at least three directors. In the absence of the Chairperson at a meeting, the members present shall elect one of the members appointed under paragraph to preside at that meeting of the Board.

A quorum for any meeting of the Board shall be the Chairperson, the Governor and three directors. Decisions of the Board are adopted by a majority of the votes of those present at that meeting and in case of an equality of votes the Chairperson or the person presiding at the meeting shall have a second or casting vote. The Board may delegate to any committee of the Board or to any member thereof, or to any officer, employee or agent of the Bank the exercise of any of the powers or the performance of any of the functions or duties of the Board under the CBK Act or any other written law.

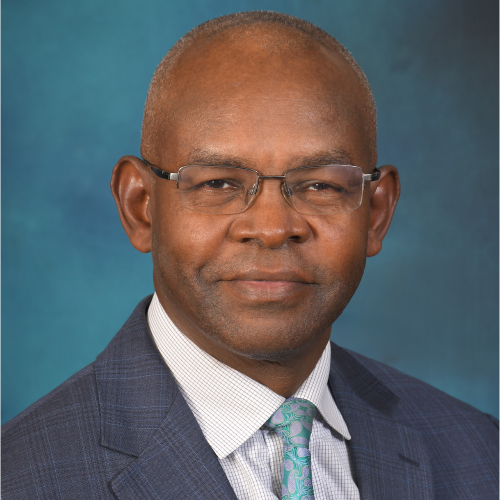

Andrew Mukite Musangi

Board Chairman

Read More

Mr. Musangi was appointed as the Chairman of the Board of Directors by H.E. President William Ruto for a four-year term in September 2023. Mr. Musangi obtained his Bachelor of Laws (LLB) Honours Degree from the University of Hull (UK) and was admitted to the Bar in 1995. He is a member of the Law Society of Kenya and the Commonwealth Lawyers Association. He is a Senior Partner at Mukite Musangi and Company Advocates and has 29 years experience in diverse areas of mainly corporate and commercial legal practice.

Mr. Musangi has served as Chairman of the Public Procurement Regulatory Board and of the Rift Valley Law Society and as Council Member of the Nakuru Business Association. He also Chairs the Boards of GenAfrica Asset Managers and Smart Applications International and serves on the Boards of Centum Investment Company PLC and Haco Industries.

He currently advises several local and multi-national corporations on governance, strategy and legal matters in a variety of economic sectors.

Nelius W. Kariuki

Board Member

Read More

Samson K. Cherutich

Board Member

Read More

Rachel B. Dzombo

Board Member

Read More

Ravi Ruparel

Board Member

Read More

Over the last few years Ravi has served as an Advisor to the Financial Sector Deepening (FSD) Trusts in East Africa and to the World Bank Group’s Finance, Competitiveness and Innovation Practice. Ravi’s prior experience includes twelve years with the World Bank Group in Washington DC as a Senior Financial Sector Specialist and Senior Internal Auditor. Before that he was a Senior Manager in the Emerging Markets practice of Deloitte in Washington DC.

Ravi holds an MBA in Finance and Strategy from the University of California, Berkeley and a BA Land (Urban) Economics – First Class Honors – from the University of Nairobi. His early education was at Jamhuri High School and Parklands Primary School.

Below the management is a team of senior staff who head departments and are responsible for management of various functions.

Management

The Governor is the chief executive officer of the Bank and, subject to the general policy decisions of the Board, is responsible for the management of the Bank, including the organisation, appointment and dismissal of the staff in accordance with the general terms and conditions of service established by the Board, the Governor has authority to incur expenditure for the Bank within the administrative budget approved by the Board.

Management Team

Dr Kamau Thugge

Governor

Read More

Dr. Kamau Thugge C.B.S., is the tenth Governor of the Central Bank of Kenya (CBK), and has been in office since June 19, 2023.

Dr. Thugge joined CBK after a long and distinguished career in the international and Kenyan public service. He worked in the International Monetary Fund (IMF) in both policymaking and non-policymaking departments. These include the Policy Review and Development Department and the Trade Policy Division. In these roles, Dr. Thugge helped to design the Highly Indebted Poor Countries Initiative (HIPC) as well as other policy initiatives. He also worked on various Article IV missions. Dr. Thugge also served as Mission Chief to Botswana and Lesotho in the wake of the Global Financial Crisis.

Dr. Thugge has held various senior roles in Kenya, including as the Head of the Fiscal and Monetary Affairs Department at the National Treasury, as Economic Secretary and as Senior Economic Advisor. Dr. Thugge also served as Principal Secretary at the National Treasury, and lately as Senior Advisor to the President and Head of Fiscal and Budget Affairs. Dr. Thugge helped to design and implement various laws including the Public Finance Management Act, the Commission on Revenue Allocation Act, the Independent Officers (Appointment) Act, the Public Procurement and Disposal of Assets Act, and many more. In these roles, he also served on various boards including that of the Central Bank of Kenya, the Monetary Policy Advisory Committee (and later the Monetary Policy Committee), the Kenya Revenue Authority and the Capital Markets Authority.

The Governor holds a Bachelor’s Degree from the Colorado College, and Master’s and PhD Degrees in Economics from Johns Hopkins University in the United States.

Dr. Susan Koech

Deputy Governor

Read More

Dr. Susan Koech is the Deputy Governor of the Central Bank of Kenya, and has served since March 10, 2023.

Prior to that she was the Principal Secretary, State Department of Wildlife. She also served as the Principal Secretary for East African Community and at the State Department for Regional Development. Dr. Koech has over 20 years distinguished career in the Banking industry having served in various senior leadership positions before transitioning into the public sector.

During her tenure as a Principal Secretary, Dr. Koech is accredited with establishing and negotiating for trade and investment country positions at the Regional level and strengthening bilateral relations and engagements across the East African Community (EAC) Member States. She ensured that sound country positions were pursued, a complex and dynamic process that called for consensus building in a competing interest environment in a bid to support regional integration and shared prosperity. She was instrumental in advocating for the establishment of the East African Monetary Union as a way of strengthening Intra-EAC trade and investments. She developed the Jumuiya Market concept that creates common markets at the border points to spur economic activity for women and youth. As PS Wildlife she developed innovative sustainable financial and economic models to achieve best practices in wildlife conservation.

During her time in banking, she championed innovation as a way of improving compliance and driving performance, endearing her to peak performance for all the teams she mentored over the years. She acquired invaluable expertise in Monetary and Financial management, Governance, People Management and Development, Strategic Management and strong interpersonal skills.

She holds a Doctor of Philosophy in Business Management and a Master of Business Administration (MBA) in Strategic Management from Moi University.

Senior Staff

Mr Kennedy K. Abuga

Director, Governors' Office

Read More

Mr. Kennedy Kaunda Abuga is the Director, Governors’ Office and was appointed CBK’s General Counsel in April 2020. Mr. Abuga joined the Bank in February 2005 as Senior Manager, Legal Services and was subsequently appointed Board Secretary and Director, Governors’ Office in April 2008. He has also served on the Board of the Insurance Regulatory Authority as an Alternate Member to the Governor.

Mr. Abuga is a Senior Advocate of the High Court of Kenya, holds an LLB Law degree from the University of Nairobi and is a Certified Public Secretary (CPSK). He is an Associate of the Chartered Institute of Bankers (ACIB), London, and holds a Diploma in Mortgage Lending from the Chartered Institute of Bankers, London. Mr. Abuga further holds a BSc. Degree in Financial Services from the University of Manchester, UK and a Masters in Business Administration (MBA) degree from USIU. Prior to joining the Bank, Mr. Abuga practised law at Salim Dhanji and Company Advocates and worked as a Senior Legal Manager for the Co-operative Bank of Kenya.

Mr Gerald A. Nyaoma

Director, Bank Supervision

Read More

Mr David Luusa

Director, Financial Markets

Read More

Mr David Luusa is the Director, Financial Markets Department. He joined the Bank in April 2020. He holds a Master of Arts degree in Economic Science from the University of Aberdeen. Prior to joining the Bank, Mr Luusa served at Standard Chartered Bank as a member of the Executive Committee and Head of Financial Markets in the East Africa region. He has extensive banking experience across different markets in Africa and Europe holding senior leadership responsibility within financial markets.

Mr Luusa serves on the Monetary Policy Committee of the Central Bank of Kenya. He also serves on the Board of the Capital Markets Authority as an alternate member to the Governor.

Mr William Nyagaka

Director, Kenya School of Monetary Studies

Read More

Mr William Nyagaka joined the Bank in May 1994. He was appointed Director, Kenya School of Monetary Studies in June 2020. He previously served as Director, Financial Markets and Internal Audit. He holds an MBA (Finance), and a Bachelor of Commerce (Accounting) degree from the University of Nairobi. He is a Certified Public Accountant (CPAK) and a Certified Public Secretary (CPSK). Mr Nyagaka also holds a Bachelor of Laws degree (LLB) from the University of Nairobi and a Diploma in Law from the Kenya School of Law. He is an Advocate of the High Court of Kenya.

Prior to joining the Bank, he worked at the Office of the Controller and Auditor General and the Kenya Power and Lighting Company Limited. He has served in various departments, including Finance, Banking, Financial Markets, Bank Supervision and Deposit Protection Fund Board. He also served, on secondment, at the Kenya Revenue Authority (KRA) during its formative stages.

Mr Paul K. Wanyagi

Director, Currency Operations

Read More

Mr. Paul K. Wanyagi was appointed Director, Currency Operations Department (COD) in July 2023. Mr. Wanyagi joined the Bank in March 1999. He holds an Executive MBA degree from Kenyatta University, a Bachelor of Commerce (Accounting Option) degree from the University of Nairobi and is a Certified Public Accountant (CPAK).

Mr Wanyagi served in Bank Supervision before being transferred to Currency Operations and Branch Administration in 2009.

Prior to joining the Bank, he worked as an external auditor with Ernst & Young and later with Coopers & Lybrand. He also worked as an assistant financial controller with Conservation Corporation Africa (CCA) Ltd.

Mr Michael Eganza

Director, Banking and Payment Services

Read More

Mr. Michael Eganza is the Director, Banking and Payment Services. He joined the Bank in January 2021. He holds a Master in Business Administration (Finance) degree from United States International University, Africa and a Bachelor’s degree in Economics and Business Studies from Kenyatta University.

Mr. Eganza has over 20 years banking experience cutting across technology, client experience, cash and trade management services, financial markets operations and risk/controls. His experience spans over multiple geographies in Africa and Asia. Prior to joining the Bank, Mr. Eganza worked with I&M Bank Kenya and Standard Chartered Bank Kenya in various senior management roles.

Mr Stephen Muriu

Director, General Services

Read More

Mr Stephen Muriu is the Director, General Services Department. He joined the Bank in December 2019. He is a holder of a Masters of Business Administration Degree in Finance from St John’s University, New York and a Bachelor of Science Degree in Business Administration and Economics from Jersey City University, New Jersey.

Mr Muriu is a seasoned financial services sector professional, with over thirty years’ experience in Corporate and Investment Banking, Commercial and Financial Advisory services, Business Development and Strategic Management. Prior to his appointment at the Bank, Mr Muriu was the CEO of African Alliance Kenya Investment Bank – Asset Management Division looking after their regional East Africa business. He has also held senior leadership roles at Standard Chartered Bank, KCB Bank and Stanbic Bank amongst others.

Ms Darliah Mbugua

Director, Human Resources

Read More

Ms. Darliah Mbugua is the Director, Human Resources. She joined the Bank in September 2020. She holds a Bachelor of Education degree in French, Business Studies and Education from Kenyatta University. She is a member of the Institute of Human Resources Management (IHRM).

Ms. Mbugua has over 25 years’ experience in Human Resources Management in HR Strategy formulation and implementation, Organizational Effectiveness, Culture Transformation, Staffing and Recruitment, Succession Planning, Talent Management, Compensation and Benefits, Performance Management, HR Policy & Procedure and Employee Relations. She has worked in several organizations based in Eastern, Western, Central and Southern Africa. Prior to joining the Bank, she was the Head of Human Capital for Stanbic Bank Kenya Limited. She has also held senior leadership roles in Coca-Cola Africa, Citigroup and Ecobank Group.

Prof Robert Mudida

Director, Research

Read More

Prof. Robert Mudida is the Director, Research Department. He joined the Bank in July 2021. He holds a PhD and an MA in International Studies as well as a BA in Economics from the University of Nairobi. He also has an MSc in Financial Economics from the University of London, School of Oriental and African Studies. Prof. Mudida is a member of the Royal Economic Society and Society for Financial Econometrics.

A seasoned economist, Prof. Mudida has more than two decades of experience in macroeconomic and applied econometric research and capacity-building with a focus on time series analysis, panel data econometrics and experimental economics. He has garnered extensive experience as a distinguished visiting professor in several leading global universities. Prof. Mudida has also served as the lead consultant for several projects in various institutions such as the World Bank, the United Nations Economic Commission for Africa, Financial Sector Deepening and the Rwandan and Ugandan Governments amongst others. He has also been awarded the IMF academic fellowship for his research on economic issues.

Prior to joining the Bank, Prof. Mudida was the Professor of Political Economy and Director of the Institute for Public Policy and Governance at Strathmore University.

Prof. Mudida has published widely in top international journals in his core areas of research which are macroeconomics, financial economics, political economy and industrial organisation. He has also published four books namely Modern Economics, Financial Management, Structural Sources of Constitutional Conflicts and An Emerging Africa in the Age of Globalisation.

Dr. Walter Onyino

Acting Director, Information Technology Department

Read More

Dr. Walter Onyino is the Acting Director, Information Technology Department. He rejoined the Bank in December 2018 from secondment at the Kenya Deposit Insurance Corporation (KDIC) where he was the Head of ICT for seven (7) years. Dr. Onyino holds a Bachelor of Science degree in Computer Science from Egerton University and a PhD in Computer Science from Lancaster University, UK. He is Certified in Governance of Enterprise Information Technology (CGEIT) and a member of the ISACA Kenya Chapter. He also holds an IT Business Manager Certification (ITBMC) from the IT Manager Institute of Belmont University.

Dr. Onyino has held senior management roles, with a wealth of experience encompassing IT Strategic Management, Software Development, IT Operations, IT Service Management, Business Continuity Planning and Bank Receiverships. He has served as a member of the Data and Research Committee of the International Association of Deposit Insurers (IADI).

Mr Leonard O. Ouma

Acting Director, Internal Audit and Risk Department

Read More

Mr. Leonard Ouma is the Acting Director, Internal Audit and Risk Department. He joined the Bank in September 2022. Mr. Ouma holds a Bachelor of Business Administration degree from Maseno University and a Master’s degree in Strategic Management from United States International University. He is a Certified Internal Auditor (CIA), Certified Public Accountant (CPA-K), Certified Information Systems Auditor (CISA) and Certified Fraud Examiner (CFE). He also holds a certificate in Senior Management Leadership from Strathmore University.

Mr. Ouma is a member of the Institute of Internal Auditors, Institute of Certified Public Accountants of Kenya, Information Systems Audit and Control Association, Association of Certified Fraud Examiners and Institute of Directors Kenya.

Mr. Ouma is a seasoned Audit and Risk professional with over 18 years’ experience in Governance, Risk Management and Controls spanning external audit, financial services and telecommunication sectors. Prior to joining the Central Bank, he worked at Safaricom Plc, Housing Finance, Kenya Women Microfinance Bank and MDN Kenya.

Ms Caroline Mackola

Director, Finance

Read More

Ms. Caroline Mackola is the Director, Finance Department. She joined the Bank in February 2021. Ms. Mackola holds a Bachelor of Science degree in Electrical and Electronics Engineering from Jomo Kenyatta University of Agriculture and Technology. She is a qualified certified public accountant and a member of the Institute of Certified Public Accountants, Kenya (ICPAK). She also holds an Association of Chartered Certified Accountants (ACCA) Diploma in International Financial Reporting.

Ms. Mackola has held senior leadership roles, with a wealth of experience encompassing Strategic Management, Finance Operations, Financial Controls and Compliance Management, Risk Management and Audit, Statutory Financial Management and Reporting, Taxation Management, Operational Excellence and Business Process Improvement, and Financial Systems Implementation.

Prior to joining the Bank, Ms. Mackola held senior leadership roles KCB Bank Kenya Limited and East African Breweries Ltd. She started her career as a Tax Consultant and Audit Associate at PricewaterhouseCoopers (PwC).

Mr Kibunyi Amdany

Director, Branch Administration

Read More

Mr. Kibunyi Amdany was appointed Director, Branch Administration Department in August 2023.

Mr. Amdany joined the Bank in 1991. He holds an MBA in Finance from Kenyatta University, a Bachelor of Science (Statistics) degree from the University of Nairobi and is a member of the Centre of Corporate Governance. He is a seasoned manager and trainer in Currency Operations management.

Mr. Amdany has served in various management positions in the Bank including Head of Currency Unit and Head of Banking Unit at the Mombasa Branch, and Manager of Vault and Back Office at the Head Office. He also headed the Meru, Nakuru and Nyeri Centres prior to his current position.

Risk Management is the second line of defence in the bank’s operations, following the Bank’s units and preceding the Internal Audit department. This Division creates an awareness throughout the Bank of the risks associated with its operations and works to mitigate them through assessment, reporting and review.

The Risk Management Division focuses on four key functions: risk management of the bank’s operations, business continuity management, compliance and ethics, and anti-money laundering and combatting the financing of terrorism. Risk management of the bank relates to management of risks in performance of bank operations, business continuity relates to the bank’s ability to sustain business operations even in extreme circumstances, while compliance and ethics relates to high standards of accountability and transparency. Finally, the bank’s efforts to prevent money-laundering and combat the funding of terrorism sees the Division taking steps to ensure that the bank’s facilities are not employed in either of these illegal and harmful activities.

Read More

Risk management forms the Bank’s second line of defence towards the process of achieving its mandate and strategic objectives, and is thus a central part of the Central Bank of Kenya’s (CBK) Strategic Management. The bank units form the first line of defence, whereas Internal Audit provides the third line of defence, which is independent assurance.

Risk Management

The risk management function is charged with the following roles:

a) Spearheading formulation of a Risk Management Policy for the Bank that clearly stipulates:

• The objectives of the Bank’s Risk Management arrangements.

• Structures responsible for managing risk within the Bank.

• The Bank’s risk tolerance levels.

• The Bank’s Risk Management frameworks that will help to identify, assess, monitor and manage potential risks and opportunities.

• The mode of creating risk awareness within the Bank including appropriate education.

b) Systematic assessment of risks throughout the Bank in consultation with the Departmental Heads, through interactive sessions like Control and Risk Self-Assessment (CRSA), by reviewing the Bank’s main activities and understanding how these activities can generate risks. The Function ensures that clear responsibilities and consistent frameworks are put in place to define, assess, monitor and control risk throughout the Bank, while at the same time creating risk management awareness amongst all members of staff. The main activities of the Bank which the Risk Management Function reviews on a regular basis include:

• Monetary Policy

• Financial System Stability

• Banking Services

• The Issuance of Currency

• Foreign Reserves Management and Intervention Capacity

• Real Time Gross Settlement System (RTGS) – KEPSS

• National Debt Services

• Internal support arrangements necessary for the above functions, including Procurement, Accounting, IT Services, Financial Markets Settlements, Internal Audit and Human Resources

c) Reporting, documenting and maintaining a data base for the risks identified throughout the Bank (the Risks Register) and developing risk indicators that are used to signal possible problem areas and act as an early warning system.

d) Assessing and documenting risk Incidence Reports in all areas of the Bank for management information.

e) Carrying out regular risk reviews of major projects in the Bank.

Business Continuity Management (BCM)

Central Bank of Kenya as a regulator recognises its obligation to staff, government, the public, investors and other stakeholders for the continuity of its business operations. The Bank recognises the need to have sustainable critical business operations functional at all times for the purpose of maintaining its ability to fulfil its mandate as provided for under the Central Bank of Kenya Act Cap 491 of the Laws of Kenya.

Risk Management is charged with the following roles in BCM for the Bank:

a) Spearheading the formulation and implementation of the Bank’s Business Continuity Management (BCM) programme and embedding the BCM culture within the Bank.

a) Spearheading the formulation and implementation of the Bank’s Business BCM Policy aimed at ensuring Bank’s resilience and effective response to major operational disruptions that may arise from potential disasters.

b) Coordinating the development, regular exercising and maintenance of the Bank’s Business Continuity Plan (BCP).

Compliance Risk Management and Ethics

The objective of the Bank is to meet stakeholders’ expectations consistent with its core mandate of formulating and implementing monetary policy directed at achieving and maintaining stability in the general level of prices and fostering the liquidity, solvency and proper functioning of a stable market-based financial system.

In pursuing this mandate, the

Bank is committed to adopting best practice and standards in the areas of accountability, transparency and business ethics.

Risk Management compliance is in six parts:

a) Deals with stakeholder expectations consistent with the Banks core mandate of formulating and implementing monetary policy directed at achieving and maintaining stability.

b) Deals with the scope of the policy and policy statement. Under the scope, the applicability of the policy is specified. The policy statement states what the bank aims to achieve through adopting the world’s best practices.

c) Deals with the compliance framework and spells out what it shall achieve through allocation of responsibilities, identification of compliance risk, monitoring, investigating and reporting in line with applicable laws, regulations, standards and codes of conduct.

d) Deals with the operation structure and implementation steps and it entails the identification and evaluation, setting of the policy, embedding the policy, monitoring, investigation and reporting compliance.

e) Deals with the roles and the responsibilities of different stakeholders, namely the Board, Governor, Bank Risk Management Committee, compliance function, Internal Audit and staff.

f) Deals with the review of the policy where the Risk management function shall on a regular basis assess and review the compliance policy to ensure that it remains relevant to the needs of the bank.

Anti-Money Laundering and Combatting the Financing of Terrorism (AML/CFT)

Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) are serious crimes that adversely affect the integrity of any country’s economic, social and political structures. Money laundering undermines the financial system, encourages crime, dampens Foreign Direct Investment and criminalises society.

Risk Management Function at the Central Bank of Kenya works closely with the Financial Reporting Centre (FRC) in the fight against money laundering and the financing of terrorism and is cognisant of the possibility that its services could be exposed to the risk of money laundering and terrorism financing. Through the AML/CFT Policy, the Central Bank of Kenya spells out measures to ensure that the Bank’s facilities are not used in the commission of, or to further the commission of, financial crimes, particularly money laundering and the financing of terrorist activities.

Internal Audit is the third line of defence in the Bank’s operations. It provides two key services to the Bank:

- Audit and assurance, through which it monitors the Bank’s operations,

- Consultation and advisory, wherein the department analyses work processes and makes recommendations.

Through these functions, Internal Audit plays a key role in ensuring that the Bank’s data is accurate, that the Bank is operating efficiently, and that the Bank’s departments are operating within the policies, laws and regulations that govern them.

Read More

Internal auditing is defined by the Institute of Internal Auditors as “an independent, objective assurance and consulting activity designed to add value and improve an organisation’s operations. It helps an organisation accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.”

Internal audit is a key corporate governance mechanism that complements other cornerstones of corporate governance, namely external auditors, Audit Committee and management. It assists in regulating and directing the activities of the Bank.

The Internal Audit Department is headed by a Director who is currently deputised by an Assistant Director and supported by auditors who are allocated a portfolio of operational and information systems audits to carry out during the specified period, and based on their competencies. The Director, Internal Audit, reports administratively to the Governor and operationally to the Board Audit Committee.

Internal audit performs two main functions: to provide audit/assurance and consulting/advisory services. These may be as part of their normal, routine activities or in response to specific requests from management.

Audit Services are generally a planned and objective examination of evidence for the purpose of providing an independent assessment on risk management, control or governance processes of the Bank. Examples of planned activities include financial, performance, compliance, system security, and due diligence engagements.

Advisory service activities are those whose nature and scope are agreed upon with the client and which are intended to add value and improve operations. Advisory activities may involve providing informal or formal advice, analysis, assessments, and serving on task forces and committees to review operations and make recommendations.

The Internal Audit Department has adopted a holistic, collaborative approach to auditing that combines all elements of traditional audit approaches, which include comprehensive financial, operational, and information technology (IT) reviews.