Bank History Introduction

The Central Bank of Kenya was established by an Act of Parliament of March 24, 1966 and opened its doors to the public on September 14, 1966. The Bank is now anchored in the Constitution under Article 231. The mandate of the Bank is to formulate and implement monetary policy that promotes price stability, fosters liquidity, solvency and stability of the banking sector, issue currency notes and coins, and provide banking services to the Government, commercial banks and other financial institutions.

Prior to establishment of Kenya’s central bank, the East African Currency Board (EACB) undertook the role of currency issuance in the entire East African region throughout the colonial period to independence. Prior to Kenya’s independence in 1963, the East African Currency Board (EACB) published a report advising the three countries of Kenya, Uganda and Tanganyika to establish an East African Central Bank to act as the banker to governments — the bank was to provide banking services for the commercial banks, to smoothen financial fluctuations, and to function as an instrument of official monetary policy.

At independence, the EACB started performing some central banking functions in the absence of one. They provided credit to the government and were authorised to lend to commercial banks for crop financing. However, the board’s functions could not match those of a central bank. The concept of a single central bank began being mooted though it did not succeed. This then led to the establishment of the three East African country central banks of Tanzania, Uganda and Kenya.

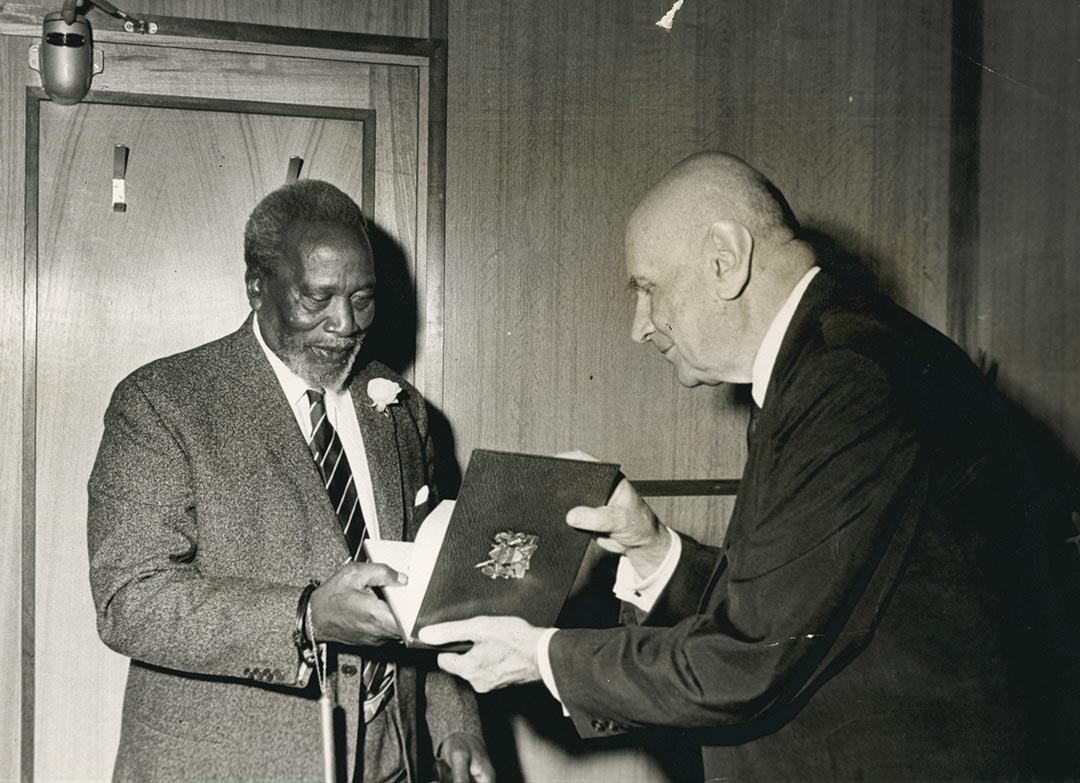

Kenya’s first President Mzee Jomo Kenyatta being presented with a set of new currency notes by CBK Governor Dr Leon Baranski on September 15, 1966.